by Kriss Hammond, CPA, CGMA

There are numerous practical, legal and tax-related issues to consider when you reflect upon leaving your collectibles to the heirs of your estate. This article is not meant to be comprehensive and cover every potential issue – otherwise, it would be similar in length to War and Peace -but it does seek to cover some of the common difficulties that appear in many estates with collectible assets. This article will provide you with three rules of thumb that apply to virtually any estate with collectibles.

Rule 1 – Have a Plan

Planning is much easier to make effective before a collector dies.

As a CPA in a firm that specializes in asset planning and taxation, we see many new clients “after the fact” – that is, the heirs or personal representative of the estate of a collector that passed on. We are not saying that there is no opportunity to adopt certain tax techniques after the death of a collector. However, the opportunities to adopt trust instruments, integrate many tax (income tax and/or estate tax) and asset protection strategies, and provide information that often only the collector knows, will be significantly limited or eliminated.

For many, the avoidance of probate is a significant goal of estate planning (though probate rules differ from state to state, so legal assistance should be considered). For those of you lucky enough to not have dealt with assets in this state, “probate” refers to a legal process of determining the validity of a will and can cause what feels like unnecessary delays in the distribution of assets to the estate’s beneficiaries. The avoidance of probate is often accomplished through assets being held in joint tenancy, assets placed in revocable living trusts (often linked with a “pour-over” will), or some other legal mechanism. Collectibles are frequently part of the “residuary” estate portion of a will or trust, meaning that they will generally be sold and split amongst the heirs according to percentages chosen by you in your documents. You can alter this by providing for “specific bequests” in your document that direct your collectibles to one or more specific beneficiaries. Keep in mind that specific bequests change the percentage of total assets that each heir ultimately receives, so you should consider this portion of your documents carefully with your legal and financial advisor.

Another important issue to consider is whether to dispose of your collectible assets prior to your death or after. To minimize exposure to capital gains tax, it’s often advantageous to retain highly appreciated coins until death. The step-up in basis rule allows heirs to reset the collectible’s tax basis to its fair market value at the time of the death, potentially reducing the tax burden on future sales. Multiple tax issues concerning the tax basis of these assets is in play and should be understood before making these decisions.

Also, if your plan is to donate all or some of your collectibles to charity, you should explore whether it makes sense to do so prior to passing or not. Donating collectible assets to charity can be a meaningful way to contribute to a cause while also providing tax benefits. It’s important to document the intended charitable contributions properly and ensure that the chosen organizations are equipped to handle such donations.

Most estates will not face the U.S. Estate Tax as the exemptions are currently quite large ($13.61M in 2024), and most will not face State Estate or Inheritance Tax laws. However, if your estate could potentially be subject to these taxes, the question of when to dispose of assets takes on an even greater significance.

Rule 2 – Name Qualified Persons

Name persons in your documents that you both trust and that have the competence to perform the assigned tasks.

It can likely be assumed that many of our readers had wills and/or living trusts prepared many years ago, and that you named your spouse as your personal representative and/or trustee. That may well have been a good idea at the time, but if both spouses are quite elderly, you should consider moving that responsibility to another person. We have dealt with many elderly surviving spouses who are simply overwhelmed by the tasks required to close an estate. Adult children or financial professionals often make better choices for fulfilling your wishes as they often have greater stamina and faculties to accomplish these tasks. It is imperative that you have complete trust in the person(s) that you are naming as personal representative and/or trustees (there can be more than one).

Also, you may wish to name certain individuals to be consulted regarding various assets of the estate. For example, a coin dealer that you trust will be extraordinarily helpful in identifying, appraising, and potentially liquidating numismatic assets of the estate. Should your heirs simply call the first coin dealer appearing on an internet search, they may end up dealing with someone who is not reputable in the business.

Rule 3 – Don’t Just Know; Document What You Have

Maintain an up-to-date inventory of all collectible items that includes purchase price, purchase date, and a description of each item.

This is a problem that we have seen with a majority of estates holding collectible items. I have seen many personal representatives walk into my office with a bag of collectibles without any clue as to what they are or what they are worth. They often just tell me that “this is the box where Mom kept her collectibles.”

There are numerous online and package software plans that make keeping an inventory of collectibles a reasonable task. You might wish to utilize one of these or take advantage of CAC’s “My Collection” to track your inventory.

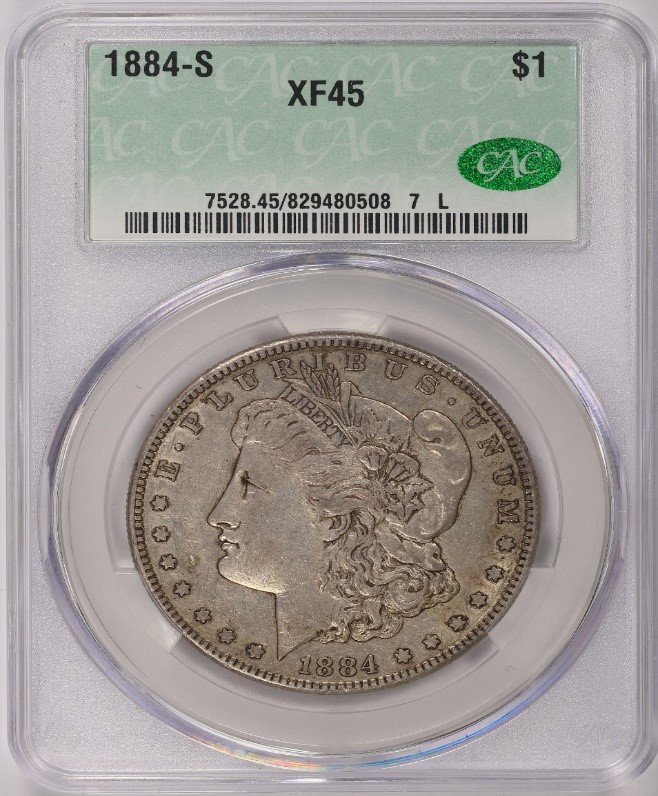

Beyond letting your personal representative or trustee use this, these inventory packages are also helpful in other ways including your annual tax return preparation and for insurance purposes. For those who only have certified coins or collectibles in their collection, the process is really quite simple as each item has its own unique certification number and can be easily identified later. Certified collectible items (such as CACG graded coins) also provide your heirs with a much better range of the current value of your collectibles and lead to a much smoother sale process later. Obviously, it is imperative that your personal representative knows how to locate and access your inventory program.

Track Your Collection in the CAC Registry!

Part of the CAC Registry, My Collection is, in its simplest form, a basic coin inventory management system. In addition to being able to track coins that can be used in the Registry (CAC, PCGS and NGC certified coins), you can also track coins certified by other grading services and even raw coins. The system includes many helpful fields such as the purchase price, who you purchased the coin from, when you purchased it, etc. Once entered, most certified coins will also show you an estimated retail value.

Conclusions

Be sure to get ahead of things and begin planning your estate now. This is not only true with collectible items but with all items of your estate. Trust me – your beneficiaries will be thankful that you took the time to plan. One key issue in planning is identifying the person(s) involved in carrying out your objectives. Be certain that they are willing, able, honest, and competent to carry out your instructions. Also, be certain to maintain an up-to-date inventory of your collectible items (as well as other estate assets). This will help to make the administration of your estate dramatically more efficient. Finally, the help of qualified professionals should be utilized to assist you in your planning efforts.

About the Author

Kriss is a CPA specializing in tax, mergers, acquisitions, and asset protection with nearly four decades of experience. He has written numerous articles relating to tax and business practices and has been a lecturer for various continuing educational programs for CPAs and attorneys. Kriss is also a long-time numismatist and owner of Numis Addicts, Inc.

If you have any questions about the topics in this article, you are welcome to reach out to him at khammond@cpnetworkinc.com.