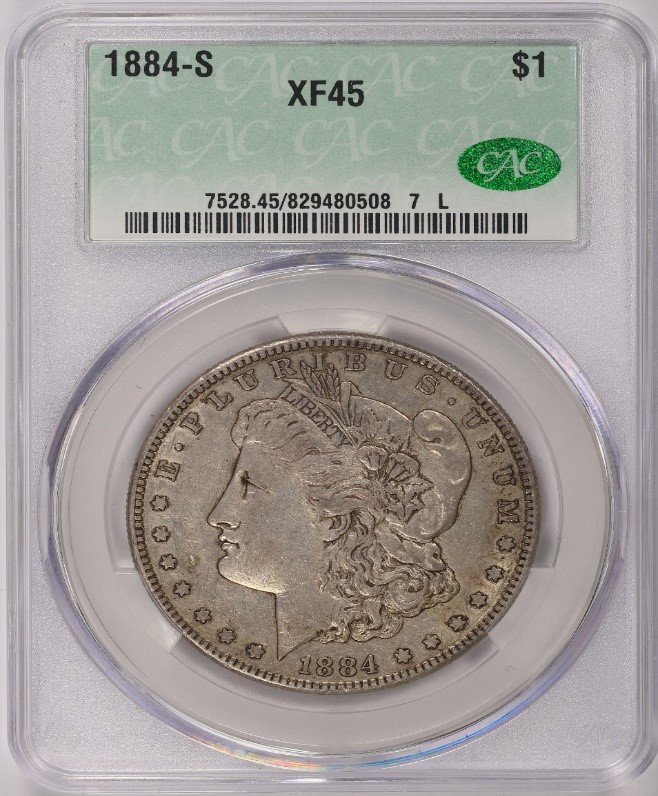

by Greg Reynolds

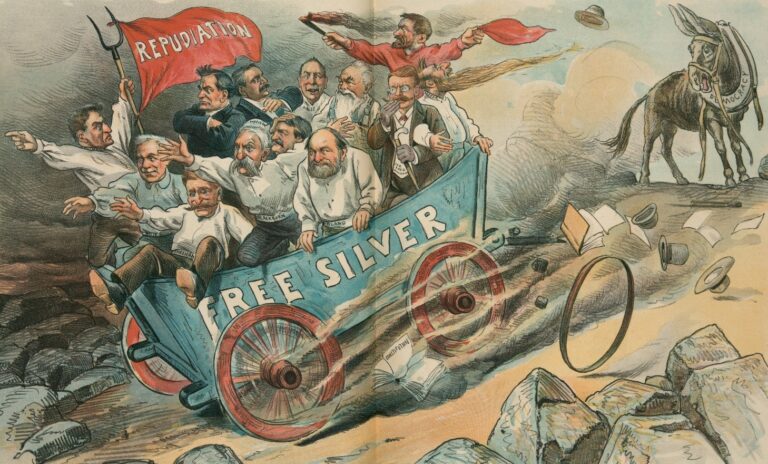

The exciting and mind boggling, first phase of Morgan silver dollars (1878-89) was detailed in a separate discussion, which is available on the CAC site. Another discussion on this site is devoted to the alarming second phase (1890-1904), which was tied to a horrid economic crisis. Silver dollar production and associated monetary policies almost led to the bankruptcy of the U.S. Federal government in the 1890s. No silver dollars were minted from 1905 to 1920, and then more than eighty million Morgan silver dollars were struck in 1921!

The minting of Morgan dollars in 1921 was not just attributable to lobbying by the silver mining industry and other political groups. Moreover, few consumers wished to use silver dollars in commerce. The production of 1921 Morgans relates to World War I and payments by Great Britain to suppliers of war materials in India.

Before Morgan dollars were minted in 1921, pre-1905 Morgan dollars were melted in 1918 and 1919 to generate silver bullion for export. The Pittman Act of April 23, 1918, was sponsored by Senator Key Pittman of Nevada. This Act, really a law, required that the U.S. Treasury Department melt tens of millions of Morgan dollars and it was implied that the resulting silver bullion would be sold to Great Britain (the United Kingdom).

The Pittman Act and Melting of Silver Dollars

The market value of silver sharply increased during the First World War, 1914 to 1918. In my interpretation, the Pittman Act indicates that the British would only have to pay U.S. $1 per Troy ounce, plus minor transaction costs, even if the market value of silver soared above $1 after the Pittman Act was passed. There is 0.7734357 Troy ounce (371.25 grains) of silver in each U.S. silver dollar. According to historical data on Kitco.com of “London Fix” annual averages in U.S. dollars, the market value of silver per Troy ounce was about $0.50 in 1914, $0.56 in 1915, $0.76 in 1916, $0.90 in 1917, $1.02 in 1918, and $1.34 in 1919. The value of silver thus more than doubled during the first world war. The primary point of the Pittman Act was to ensure that the British could soon acquire a very large quantity of silver for a price that was not exorbitant.

As the precise wording of the Pittman Act does not fully explain the reasons and effects of this law, I have quoted parts, interpreted other parts, and paraphrased some of the parts here. In the first section, the Pittman Act emphasized that the U.S. Secretary of the Treasury would order the melting of silver dollars, which were residing in government vaults, subject to conditions:

A). The maximum number of silver dollars melted must be less than 350 million.

B). The silver bullion generated from the melting of silver dollars must be sold for not less than $1 per Troy ounce of pure (1000 fine) silver. My belief is that it was implied that almost pure (999 fine = 99.9%) silver would be acceptable, as it is or was difficult to refine silver such that it is near-absolutely pure (1000 fine).

C). The melting of silver dollars taken from inside government vaults was required to be offset by the redemption or retirement of silver certificates in circulation, a form of U.S. paper money. There have been multiple forms of paper money in the history of the United States.

Each silver certificate was backed by silver dollars held by the U.S. government. Silver certificates were born as part of the Morgan dollar program in 1878, though silver certificates continued to be issued until 1963 and could still then be exchanged for silver dollars. In 1967, silver certificates were recalled and were allowed to be redeemed for silver bullion for about one year.

After 1968, the U.S. Treasury Department was no longer legally obligated to exchange silver dollars or silver bullion for silver certificates. As far as I know, however, U.S. silver certificates remain legal tender.

In 1971, President Richard Nixon formally ended the official connection between the U.S. dollar and gold and silver. A U.S. dollar is no longer equivalent to a legally established fixed-weight of a precious metal.

D). By law, the silver bullion exported under the Pittman Act had to be precisely replaced by the purchase by the U.S. Treasury of silver that was mined and processed in the United States for $1 per Troy ounce, even if the prevailing market value of silver was less than $1 per Troy ounce.

E). The U.S. Treasury Department was required by the Pittman Act to continue to mint silver dollars until the total number of silver dollars minted under the Pittman Act was precisely equal to the total number of silver dollars melted under this Act. In other words, the law mandated that each melted silver dollar be replaced by a new silver dollar.

The total number of silver dollars melted under the Pittman Act, during 1918 and 1919, was 270,232,722. In 1921, 86,730,000 Morgan dollars were minted. From 1921 to 1928, 183,502,722 Peace silver dollars were minted. The sum of Morgan and Peace dollars produced from 1921 to 1928, 270,232,722, was thus the same as the number of pre-1905 Morgan dollars that were melted in 1918 and 1919.

F) In Section 3 of the Pittman Act, it is said that “sales of silver bullion under authority of this Act” may be used for several purposes, which are listed. The true driving force behind the passage of the Pittman Act stems from the last purpose listed, “assisting foreign governments at war with the enemies of the United States.”

India and Great Britain’s Role

Until 1947, India was a colony of Great Britain. It is not often mentioned by historians that India was very active during the first world war. India furnished troops, logistical support, and large amounts of war supplies. Indeed, India played an important role in the victory by the allies.

The United Kingdom (Great Britain and territories), France, Belgium, Japan, Portugal from 1916, Russia until 1917, the United States from 1917, and others, were ‘the allies.’ Germany, the Ottoman Empire, and Austria-Hungary were leaders of the axis, a coalition that was usually called the “Central Powers.”

More than one million troops and support personnel from India participated on the side of the allies. Soldiers from India fought in battles in Belgium, France, East Africa, the Middle East and elsewhere. It is relevant to Morgan dollars that the British purchased millions of tons of war supplies from sources in India.

The payment system for goods and services purchased by the British from India was complicated. An important point is that, in Europe, most international trading was effected with gold bullion, gold coins, gold-backed currencies, and/or gold-backed financial instruments. In much of Asia, however, silver was preferred to gold in transactions, especially in regard to imports and exports. For a very long time, merchants and governments in China preferred payments in silver.

Although the standard unit in India, the rupee, had an equivalent in gold-backed British currency, the Indian government and merchants in India then really preferred payments in silver; from the British, they received payments in banknotes or “bills” that were redeemable in silver. The precise nature of these silver-backed notes, which were issued in England, is hard to explain. An immediate point is that, during the late nineteenth century and the early twentieth century, merchants and government officials in India relied upon the concept that these British banknotes or “bills” could easily be redeemed or exchanged for silver in some form. Silver reserves set aside for the purpose of backing such banknotes or “bills” were perceived as inadequate in 1918.

To assure exporters of war supplies in India and businesses in India that used British banknotes or “bills,” there was a need for the British to bolster their holdings of silver. The United States was a logical source.

German Involvement and Propaganda

Great Britain and the United States were allies before, during and after the first world war. Though Great Britain, India was an ally, too. Germany was the primary enemy in both the first and second world wars.

During both world wars, German spies and propaganda campaigns cleverly sought to cause trouble for the British. During the first world war, Germans spread rumors that the silver-backed banknotes, bank drafts or “bills” that the British used to import war materials and other goods from India were unsound; German partisans implied the notes were already losing value or were in danger of not being redeemable for silver or silver coins. The Germans suggested that the British did not have enough silver to fulfill silver-based financial obligations if called upon to do so.

The Germans attacked the credit and credibility of Great Britain. With these and other kinds of rumors, along with additional tactics, Germany sought to flame nationalist fervor in India. As Indian soldiers fought the Germans, and large quantities of supplies from India were used by the British while fighting the Germans, it was unsurprising that the Germans contributed to political forces in India that were opposed to India being a British colony. Indeed, nationalist movements in India gained substantial momentum during the first world war.

The British government strongly demanded war materials from India, and really needed them for military campaigns. Early in 1918, the British government sought to purchase silver from the United States government. The main reason was to more strongly support the silver-backed financial instruments that the British used to import war-related supplies from India and to cover other expenses relating to Indian participation in the first world war. Such British banknotes, bank drafts or semi-private “bills” actually circulated as ‘money’ in India, with the understanding that they were redeemable in silver or silver coins.

Although Great Britain, the United Kingdom and India were not explicitly mentioned in the Pittman Act, it was made apparent in 1918 that the administration of President Woodrow Wilson was agreeing to sell massive quantities of silver to the British. The Pittman Act was intended to bring about such sales. In this way, Great Britain could acquire large quantities of silver to assure government officials and businessmen in India that the banknotes or “bills” that were used to pay for imports from India, and probably often circulated in India, were fully and easily redeemable in silver or silver coins. The British could then ‘make it clear’ in general that they could fulfill obligations payable in silver or silver coins.

To purchase silver, Great Britain paid the United States with gold, gold coins and/or gold-backed instruments. It would be only a slight oversimplification to state that the U.S. government agreed to export large amounts of silver for gold, an objective that reawakened the political forces that promoted silver and sought to revive the role of silver in the U.S. monetary order.

The dream of restoring the full legal tender status of all U.S. silver coins and of practically restoring the 16:1 silver to gold ratio, which dated back to 1834, became a political issue again. Somehow, U.S. Congressmen were persuaded that the U.S. government must buy replacement silver if millions of ounces that the government already owned were to be exported.

The Pittman Act required that every single silver dollar melted must be later replaced by another silver dollar. Although this replacement program was finished by 1928, Peace silver dollars were revived in 1934 and minted in 1935, too. The reasons for those are part of another story.

Copyright © 2023 Greg Reynolds

About the Author

Greg is a professional numismatist and researcher, having written more than 775 articles published in ten different publications relating to coins, patterns, and medals. He has won awards for analyses, interpretation of rarity, historical research, and critiques. In 2002 and again in 2023, Reynolds was the sole winner of the Numismatic Literary Guild (NLG) award for “Best All-Around Portfolio”.

Greg has carefully examined thousands of truly rare and conditionally rare classic U.S. coins, including a majority of the most famous rarities. He is also an expert in British coins. He is available for private consultations.

Email: Insightful10@gmail.com